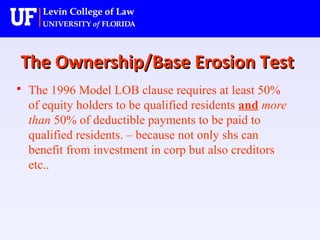

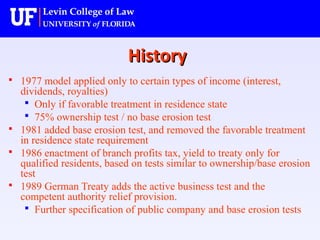

Limitation of Benefits Provisions in Tax Treaties ABA Tax Section Meeting October 17, 2002 Mark Doets – Loyens & Loeff Rick Reinhold – Willkie Farr & Gallagher. - ppt download

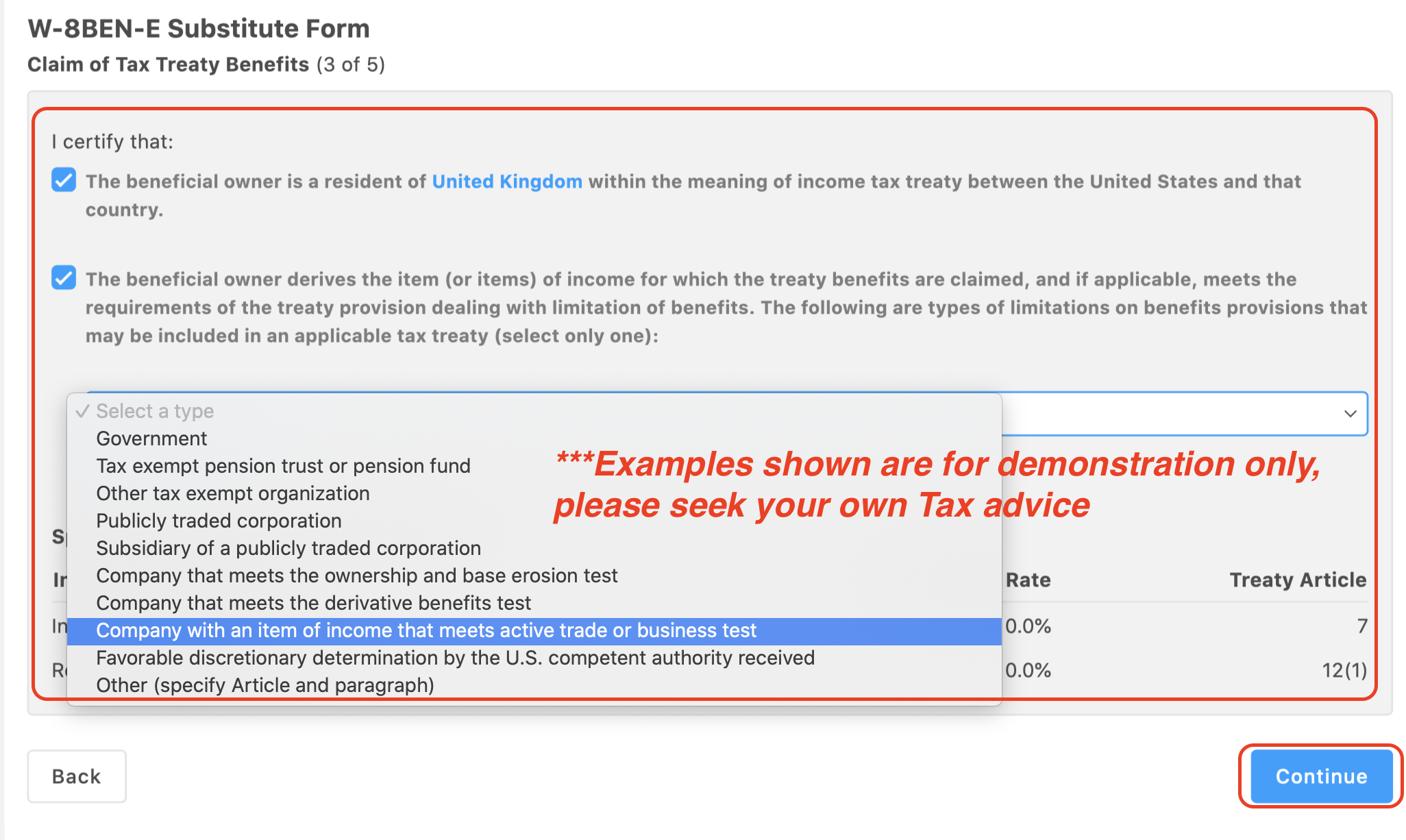

Guidelines for Completion of the Form W-8BEN-E and Foreign Account Tax Compliance Act (FATCA) Entity Classification Guide