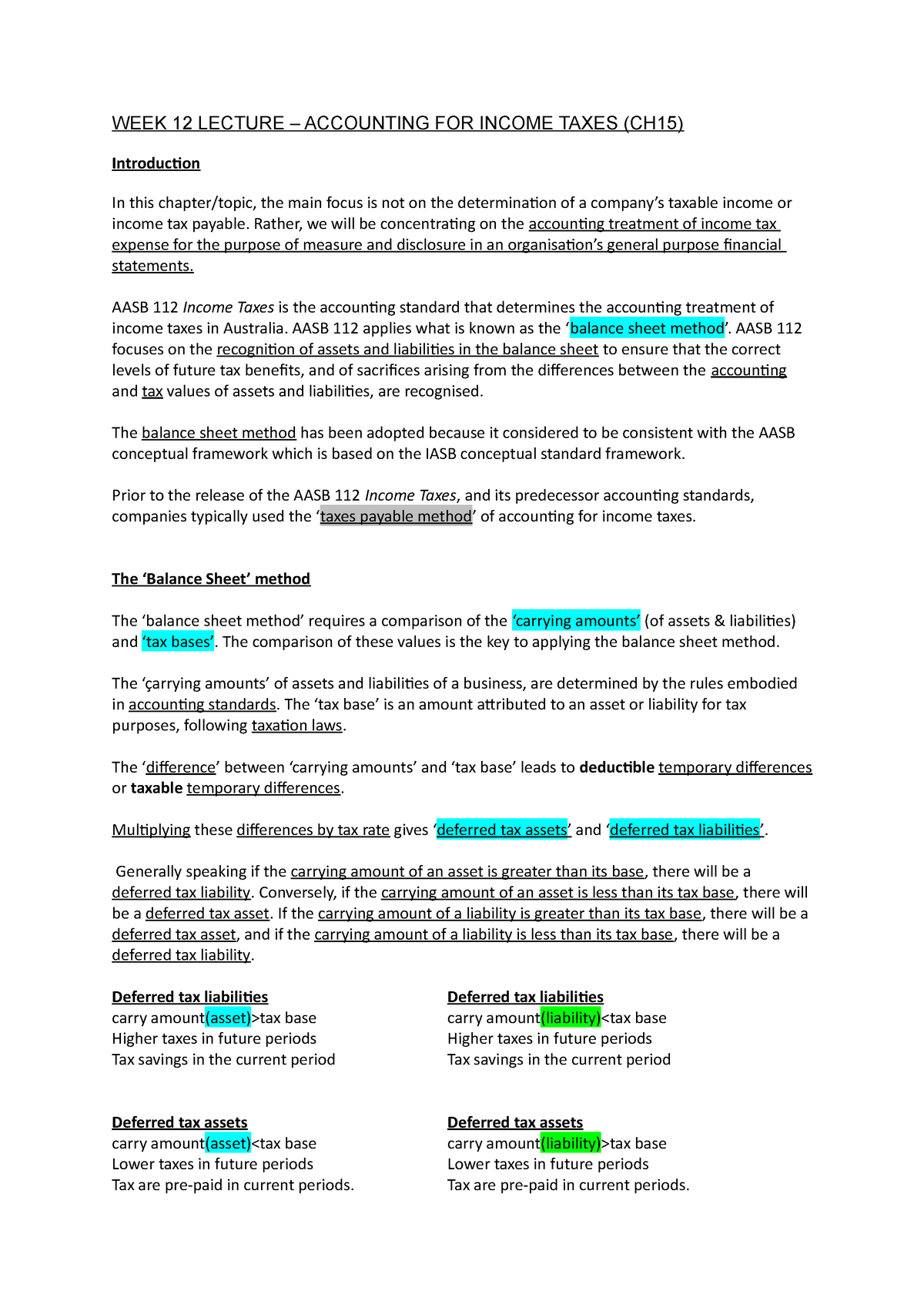

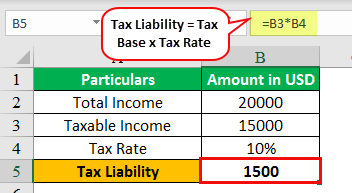

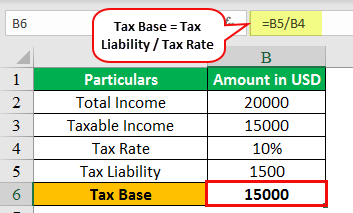

Twitter 上的Dheeraj:"Tax Base (Definition, Formula) | How to Calculate Tax Base? (Examples) https://t.co/niH4jOe94g #TaxBase https://t.co/ei1tyFCXiS" / Twitter

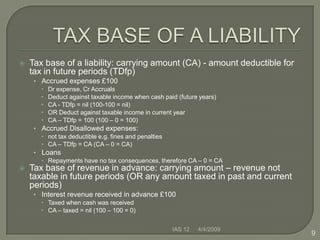

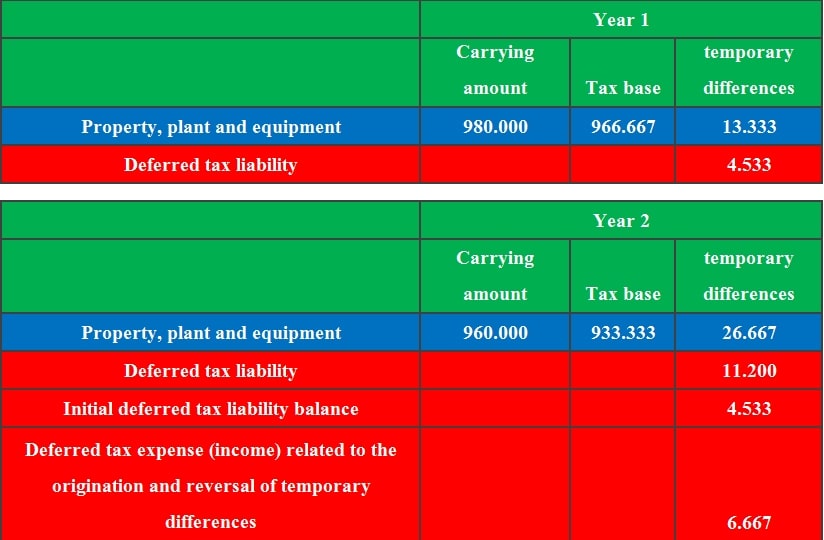

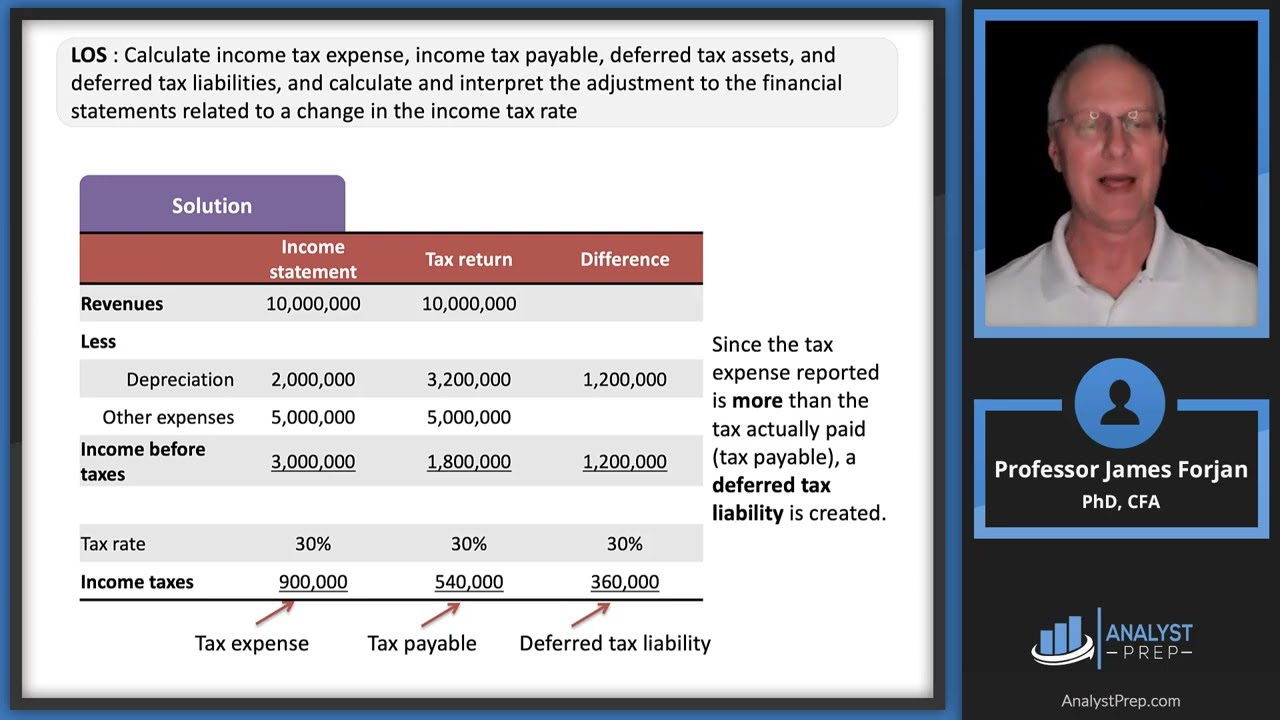

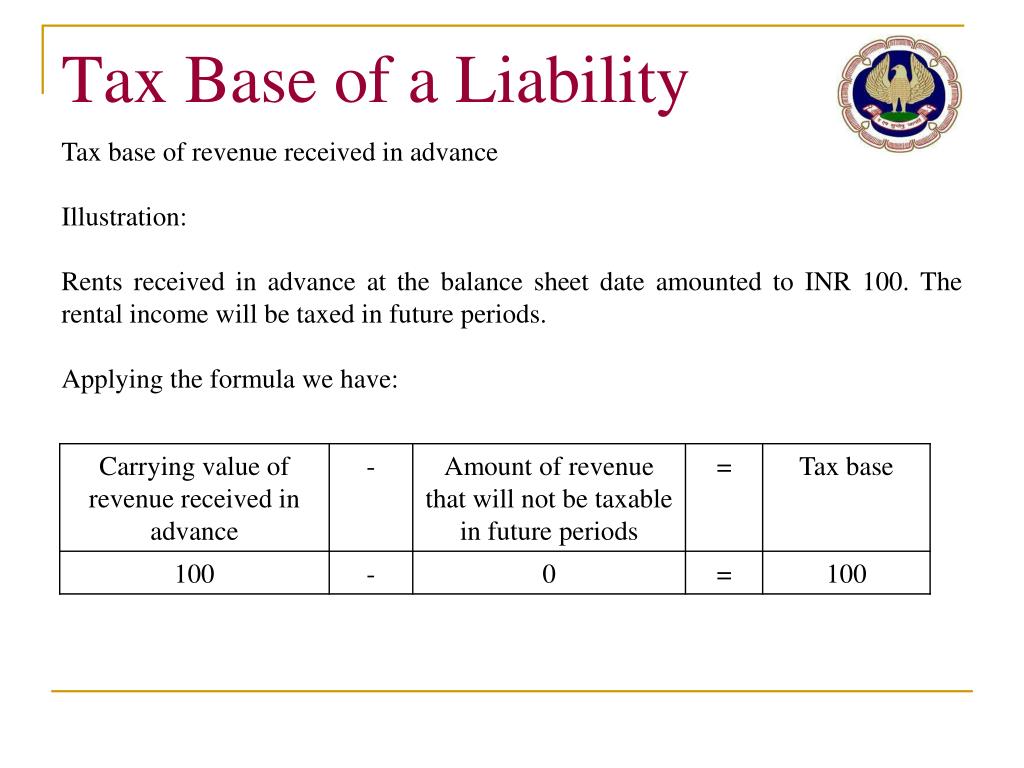

Cacique Accounting College - Today's topic - ACCA P2 - Corporate Reporting - Deferred Tax…😊 A Deferred Tax liability is an account on a company's Balance Sheet that is a result of